Send Money - Business Insights

- Payout to Cards

- Currency Management in Payouts to Cards

- KYC requirements in Payout and Money Transfer projects

- Various forms of money transfers

- Payouts, eCom Transactions or Card-to-Card Payments?

- Payout to xPay

- Card to Card Widget - How Does it Work?

- Cross-Border Card Transactions – Questions about FX Rates and Cash Flow

Payout to Cards

How does Payout to Cards work? Payout to Cards is a relatively new area of payment business that is not very common, so this article brings more information about it.

What is Payout to Cards? Actually, the answer is simple. It is nothing more than a normal bank transfer, but made to a card number instead of a bank account number.

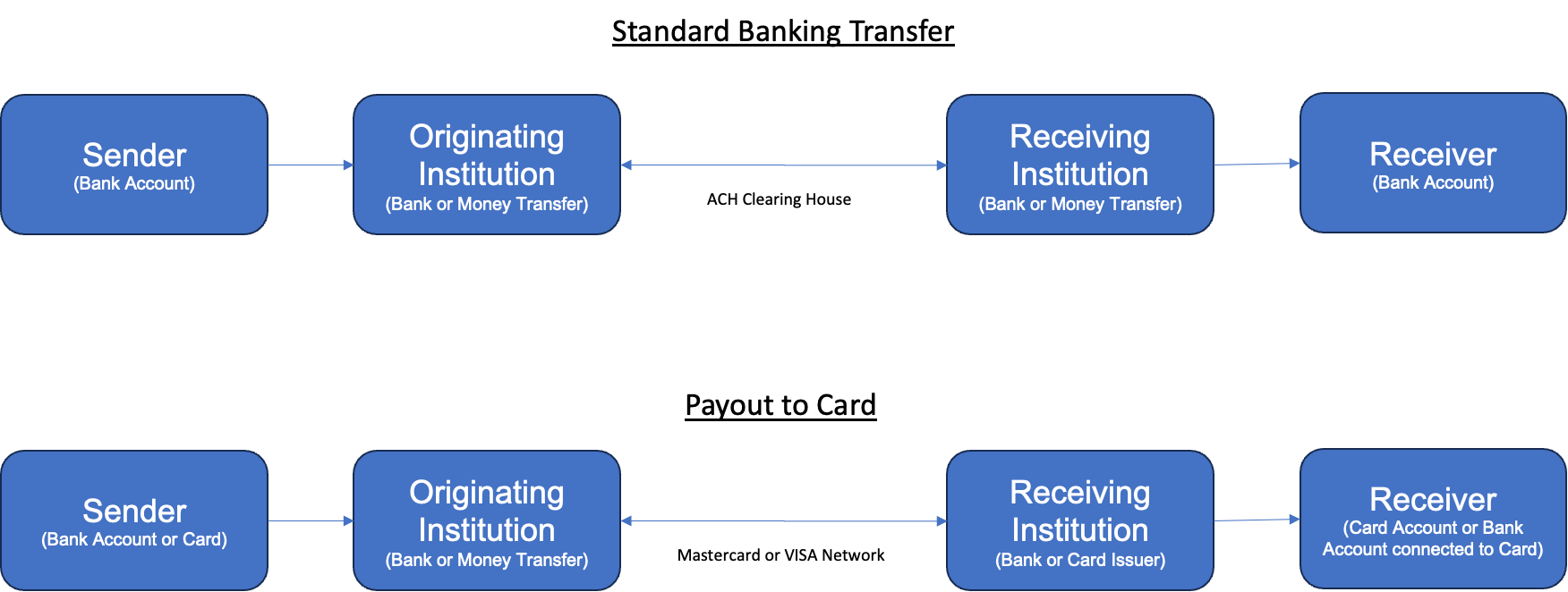

Transfers to bank accounts are pretty common and I guess we understand how they work. A bank or another financial institution connects to Automated Clearing House (usually National Clearing Center or National Bank or inter-bank organization), implements the solution on both frontend (internet banking, mobile banking, internal systems) and backend (integration with core-banking system and ACH), and once Customer wants to send money and enters IBAN (bank account) of the receiver, the transfer is performed. In such a case the bank sends technical information to ACH and sends money or performs settlement either with another bank or National Bank, or any other payment organization responsible for this transfer.

Payouts to cards work completely in the same way, but the money transfer is done to Mastercard or VISA cards. At Mastercard, this solution is called "MoneySend" (sometimes Mastercard Send or Cross-Border Send), while at VISA it is called "VISA Direct". In case of such a transaction Customer of the bank or any other money transfer organization initiates payment via the Internet or mobile application and sends money to the Primary Account Number (card number) of the receiver. The settlement of money happens via the Mastercard and VISA networks - actually through settlement bank accounts registered at Mastercard and VISA to perform a card transaction. Money is taken from the settlement account of Originating Institution (sending institution) to the settlement account of Receiving Institution.

We present this on the chart below.

In fact, there are not many differences between a standard bank transfer and Payout to Cards. Real differences are a natural result of using payment cards to process transactions. The main differences are:

- Pricing - obviously pricing of such a Payout to Cards is different than a standard banking transfer - usually more expensive. This is the outcome of the pricing policy of VISA and Mastercard. Nothing else. On average, Payout to Card costs around 0,5-1% + 0,1-0,8 EUR per transaction.

- Speed of the transfer delivery - Receiver of a Payout to Cards transaction usually receives money (globally) within 30 minutes. It is a big game changer compared to SWIFT or SEPA transfers. It really works globally. Imagine that you can send money from Brazil to Germany in 30 minutes! From Singapore to Pakistan in 30 minutes!

- Using a card number - Receiver needs to share his/her card number (only 16 digits) with Sender. This is a significant problem because we do not like sharing card numbers with other people. Actually we are taught that it is risky. This can impact a user conversion in many use cases.

- Issues with a receiving network - Sometimes it is difficult or impossible to send transactions to particular countries. For example Germany or the USA are countries where such transactions are blocked - banks usually do not accept receiving Payouts to Cards. This may be a problem for some use cases and some transaction corridors.

- Maximum transaction value - VISA and Mastercard decided that there are some maximum transaction values. Usually it is around 5-10k EUR or USD per transaction. There are also some monthly limits per user. It does affect the user experience but this value is growing over time.

In general, it is a great functionality that works well for banks around the world as competitive to SWIFT and ACH. It gives added value to the user who wants to transfer money quickly, especially internationally. Worth considering for all money transfer organizations and banks. The implementation of Payout to Cards can be greatly simplified by Verestro and our partner payment organization Fenige. Please check us out!

Currency Management in Payouts to Cards

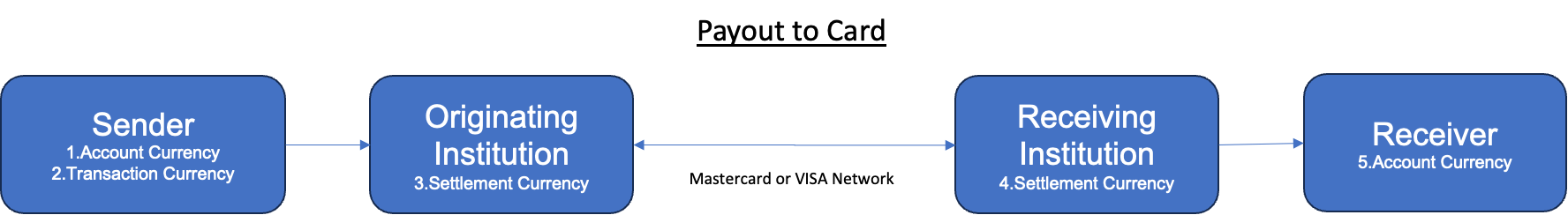

There are many questions about how to manage currencies in payout products. Let me briefly describe several possible scenarios.

Let's start with dependencies that have an impact on choosing various scenarios.

- Sender's card account currency - first you have a user with a payment account in a particular currency, for example USD, EUR, CHF, RON etc.

- Transaction currency - transaction that sending user can choose

- Acquirer settlement currency - there are settlement currencies that an acquiring institution (Originating Institution) cooperating with VISA or Mastercard uses to settle money with them, for example USD, EUR, PLN. Of course, it can differ from the user account currency.

- Receiver's card issuer settlement currency - a bank, which issues a card for the receiver, can have various settlement currencies with Mastercard or VISA.

- Receiving card settlement currency - additionally, there is a settlement currency of the receiver's card, issued by another bank. It can be any currency, for example UAH, CZK.

That's why it is complex. At various levels of transactions there are various currencies and of course in case of currency conversion at any step various additional FX fees apply. That's why the choice of currency management strategy is not an easy one.

Additional decision factors are related to particular use cases I want to present. There are a few possible ways of offering Payouts to the user. Let's have a look at 3 scenarios:

- User chooses how much money in their currency they want to transfer - example: User has an account in USD and wants to send 100 USD to a friend. User does not know if the friend has an account in USD, EUR or PLN. He/she does not care.

- A. In such a case there is no problem if Sender and Receiver, Acquirer and Issuer have an account in the same currency as available settlement accounts of Acquirer. Transactions will be processed and settled in the same currency through the chain. This almost always applies for USD, EUR transactions.

- B. If Sender has an account in USD, Acquirer has a settlement currency in USD, Issuer has a settlement currency in EUR, Receiver has a card account in EUR, there will be currency conversion that will happen on Receiver's side. His/her bank (card issuer) will convert the incoming USD to EUR and charge currency conversion fees.

- C. If Sender has an account in CZK, but Acquirer does not have a settlement currency in CZK, but only USD and Receiver has an account in USD, there will be conversion happening on Sender's (acquirer) side. The sending institution will convert 1000 CZK of User to USD, will charge currency conversion fees and Receiver will receive USD after conversion. Receiver's bank will not get any currency conversion fees.

- User chooses currency of Receiver - Example: User has an account in USD but needs to pay 100 EUR to Receiver because he/she knows that Receiver wants to get 100 EUR.

- D. It is possible to recognise the settlement currency of Receiver thanks to BIN tables shared through payment schemes. Thanks to it Sender will know that Receiver's card is issued in USD, so only USD will be allowed for this transaction. In such a case currency conversion will always happen on Sender's side. In case User has an account with EUR, their Acquirer (Originating Institution) will convert 100 EUR to USD and will initiate a transaction in USD. In case User account is in a different currency than the settlement account of Acquirer, additional currency conversion fees will apply and will be charged by Acquirer.

- User does not have a choice - in such a case we offer only a payment in currency defined by the payment provider, for example always the same currency as the User account.

- E. In such a case User can send only one currency. Usually the same as his/her account currency. If User's account currency is the same as the settlement account of Acquirer, the transaction will be processed as in point 1B, which means that currency conversion can happen on Receiver's side if Receiver's card currency is different from the settlement currency.

- F. In case User can send money in the currency which is not the settlement account of Acquirer in, some additional conversion fees will apply on Acquirer's side (like in scenario 1C).

It may look complicated, but if you look at it from the point of view of currency conversion points (5 places where conversion can happen) it is easier to understand.

Our recommendation is to use Scenario 1 and focus on implementing Scenario 1A (we can enable currencies which will be the most popular for your payment corridors). In some cases our partners use Scenario 2. It is important that calculation of commissions and spread is always dynamic, so Sender knows in advance the cost of these transactions.

I hope this article can help you understand currency conversion details. Thank you for reading.

KYC requirements in Payout and Money Transfer projects

Know Your Customer (KYC) processes usually generate many questions. Key requirements and decision points are summarized in this article.

The KYC regulations are directly related to AML (Anti-Money Laundering), regulatory and payment scheme requirements. In general, any payment or banking institution has to know who their customers are, what the source of their customers' money is and how the customers use the money held by the payment institution. To limit the risk of supporting terrorist or illegal activities, regulators require payment institutions to be aware of and monitor them.

The key question in every project is: "Who is the owner of the money on the account?" There may be the following situations:

- CONSUMERS - If consumers own the money on account, the KYC process has to happen. It usually means that the user (consumer - not a company) needs to provide his/her ID document or passport and selfie, a meeting or video call needs to happen to make sure that the consumer is a real person who signs a contract with the payment institution. There are many additional verification ways that the payment institution may require, but these are the main ones.

- BUSINESSES - If a company owns the money, the KYB (Know Your Business) process has to happen. It usually means that the user (company owner, manager etc.) needs to provide not only his/her ID document and make a selfie or a video call, but the payment institution needs to check beneficiaries (owners of more than 25% of shares in the company).

In both cases, the payment institution is obliged to check whether the consumer, company director or company owner is on various sanctions lists, e.g. OFAC or UN sanctions lists.

The above rules are critical and in fact all other implications are results of them. In projects related to the implementation of Payout to Cards, the first question we need to answer is: "Who is the owner of the money on the account?" If the consumer is the owner of the account (scenario 1) - the consumer must go through the KYC process. If the business is an owner of the money on the account (scenario 2), the KYB process will have to happen and there will be no additional KYC.

In the majority of Payout to Cards projects we are in Scenario 2. It means that the KYB process needs to happen and there will be no additional verification of consumers. The reason for that is that we usually talk with payment institutions, wallets, fintechs that have registered users, the users have their accounts (already after KYC) and our money transfer institution will work directly with this business customer to enable Payouts from accounts of this payment institution to the receiver. The account owner will be a payment institution or a business that we work with. From a legal point of view, our customer (B2B customer) will take money from the user's account, place it on their own account and initiate a payment to the receiver from their own account. In such a situation we will do KYB, we will verify if our partner has a legal right to perform such activities and it will be enough. We will request our partners to send us some customer (Sender) data including the first name, last name, but nothing else.

In some situations there will be a need to initiate direct payments from the consumer account to the receiver - Scenario 1. In this scenario we will require that either the partner does a professional KYC process according to requirements (see above) and sends results of KYC to us, including a selfie, ID documents etc. Or in specific cases we can perform KYC on behalf of the partner.

I hope I clarified the topic. Please make sure that you define quickly if you are in scenario 1 (consumer KYC) or scenario 2 (business KYB) and you can quickly enable Payouts with us.

Thanks for reading.

Various forms of money transfers

There are multiple forms of money transfers. In this article we would like to summarize the most important pros and cons of every solution:

- SWIFT (Society for Worldwide Interbank Financial Telecommunication) - inter-banking payment scheme enabling global transfer, International standard

- Pros - almost any currency; global network, unlimited amount of transfer

- Cons - time of transaction (sometimes a week); cost of transaction (example: 0,3%+10 usd or more); available to banks only

- Payouts to Cards - using Mastercard and VISA network, global transfers, international standard

- Pros - almost any currency; global network; speed (even 30 minutes to transfer money between continents

- Cons - Cost of transaction (example: 1% + 0,5 usd), limited amount of transfer (10.000 USD)

- Crypto - using cryptography to transfer value, global transfer, international standard but sometimes forbidden by law

- Pros - multiple but virtual currencies; global network; speed (even 5 minutes)

- Cons - high costs (example: 1-2%), very often forbidden by regulators, risk of losing money, needs crypto exchange involvement

- SEPA (Single Euro Payment Area) - European standard or euro currency standard

- Pros - speed (immediately or 1 day), price (below 1 EUR)

- Cons - works only from EUR to EUR, works only in the European Union

- Payouts to wallets - various providers offer various payouts mechanisms to multiply local wallet providers or cash-out networks

- Pros - localization

- Cons - no global standard in speed and price, usually more expensive

- Virtual cards - you can issue a virtual card, send card data to the receiver and the receiver can use the card globally

- Pros - global standard, very quick and very cheap, receiver can use card for ATM withdrawal, POS and eCommerce payments

- Cons - non-standard way of sending money, receiver reluctance

- Local ACH (Automated Clearing House or local scheme) - there are multiple local or national payment schemes globally that you can use once you integrate with them. Usually requires a bank license to integrate.

- Pros - quick and cheap, standard in the country

- Cons - no global standard, works only locally

If you are asking yourself which solution you should use for your user it is actually a wrong question. We recommend using all. Give choice to your users, apply various fees on various methods of transfer, let users choose the best way of payments for them. It is actually very important strategy because:

- for users in Poland SEPA transfer or local ACH are the most common ways of payments nowadays

- for users in Ukraine Payouts to cards are the most common mechanism they have been using for years

- for users in USA SWIFT or local payment schemes are the most common mechanism

If you are building an international service, you really need multiple ways of sending money for your users.

Thanks for reading.

Payouts, eCom Transactions or Card-to-Card Payments?

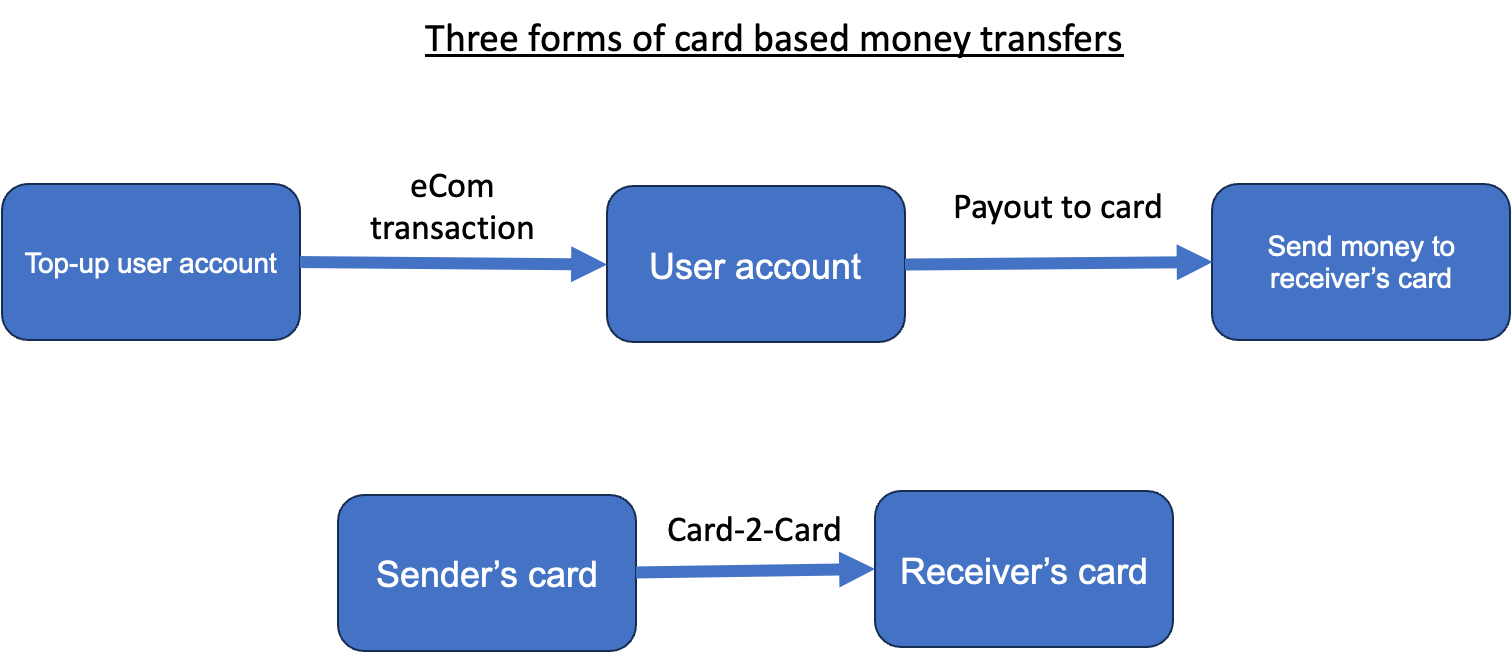

While thinking about card-based money transfer solutions, our partners usually ask for three products - payouts to cards, eCom transactions or card-to-card payments. In this article we will describe differences between those 3 ways of money transfers.

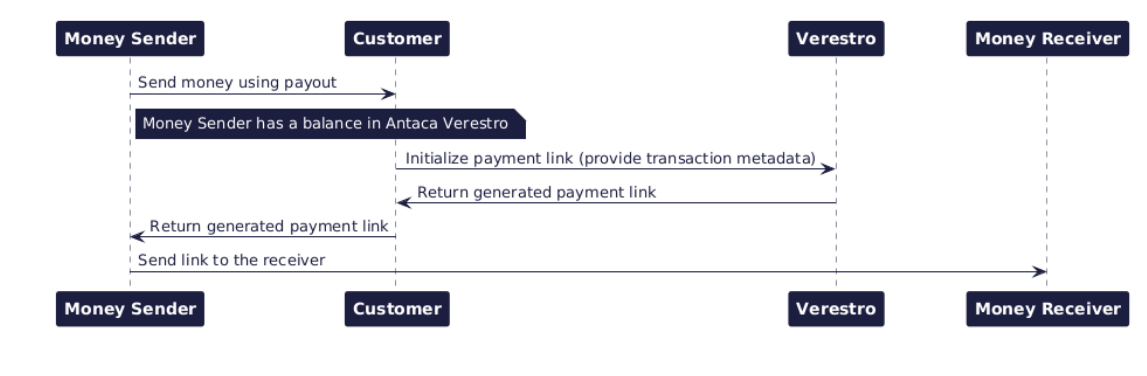

Let me start with a chart.

There are three use cases that you may be interested in. The choice of product depends on a use case decision.

Use Case 1. Top-up user account - in this case our starting point is the user's account kept somewhere in your systems. Your users need to reload this account with money. You can use various forms of transfers to your account, but if you want to reload an account from Mastercard or VISA card, we should enable eCom transactions to you. You will be registered as a merchant with our partnering acquirers and we will enable payments using cards, Apple Pay, Google Pay or other means of payment.

Use Case 2. Payout to card - in this case we assume that your user has an account and money on this account. We need to enable payments from this account to any card in the world. This money transfer will be very quick - less than 30 minutes. In this case you should be using our product called "Payouts to cards". This will enable your user to transfer money to any Mastercard or VISA card.

Use Case 3. Card-2-Card - in this case our assumption is that you do not have a user's account. You do not store the money of your users. You just want to enable a money transfer service from one card to another card. From Mastercard to VISA, VISA to Mastercard or Mastercard to Mastercard or VISA to VISA card. In such a case we recommend that you use our card-2-card product.

It is important not to mix those use cases and choose the correct product. All three products have different fees, AML requirements so please think of your use case and let's decide what to use.

Thanks for reading.

Payout to xPay

What is it about?

We often find ourselves in situations where we need to transfer money to someone else. We also want the funds to reach the recipient as quickly as possible and for the transfer fee to be as low as possible. Additionally, different countries offer specific transfer methods that may not be available elsewhere—for example, BLIK in Poland.

In such cases, many people consider a standard SEPA/SWIFT transfer. While this is a solution, such transfers usually take until the next day to arrive. Moreover, we don’t always have the recipient’s account number or IBAN which is obligatory in this case.

The best option is to initiate a transfer without needing to enter any of the recipient’s payment instrument details such as card number or account number (besides, in many cases we will not be able to get such data). It is enough for your recipient to have any messaging app so that you can notify them that you are sending funds, which he or she can then collect onto his or her card from the xPay wallet such as Apple Pay or Google Pay wallet.

In this article, I will try to explain how xPay card tokens work, how you can easily send funds as a sender without knowing the recipient’s account number, card number, etc., and how to receive such a transfer using xPay wallets as a recipient.

xPay wallet - what is it?

Let’s start this chapter by explaining what xPay wallets are. These are digital wallets that store cards online and enable fast and secure payments without the need for a physical card. They work on smartphones, smartwatches, and other mobile devices. The two most popular xPay wallets are, of course, Apple Pay and Google Pay. Both of these wallets are available in almost all parts of the world.

How does it work?

Let's describe the basic xPay wallet flow step by step:

- Adding a card – The user adds his payment card to the wallet (Apple Wallet for Apple Pay, Google Wallet for Google Pay). This can be done manually or through a banking app.

- Tokenization – Card details are not stored or shared during transactions. Instead, the system generates a unique "token" (an encrypted card identifier), which enhances security. We will talk more about this step later.

- Contactless payments – To pay in a physical store, simply hold a phone or smartwatch near a payment terminal and authenticate the transaction using Face ID, Touch ID, or a PIN code.

- Online and in-app payments – Users can also pay in online stores and apps without entering their card details—just select Apple Pay or Google Pay as the payment method.

- Security – Apple Pay and Google Pay do not share actual card details with merchants, minimizing the risk of fraud.

Both systems (either Apple Pay and Google Pay) are available in many countries and are compatible with most banks and payment cards.

What is an xPay card token?

An xPay card token is a unique, encrypted identifier generated for a user’s payment card when it is added to the xPay wallet. Instead of storing or transmitting the actual card details during transactions, xPay uses this token to complete the payment process. This tokenization process enhances security by protecting sensitive card information and minimizing the risk of fraud.

In simpler terms, the token acts as a reference for your card number, allowing you to make secure payments without exposing your real card data. This token has the structure of a standard PAN (Primary Account Number).

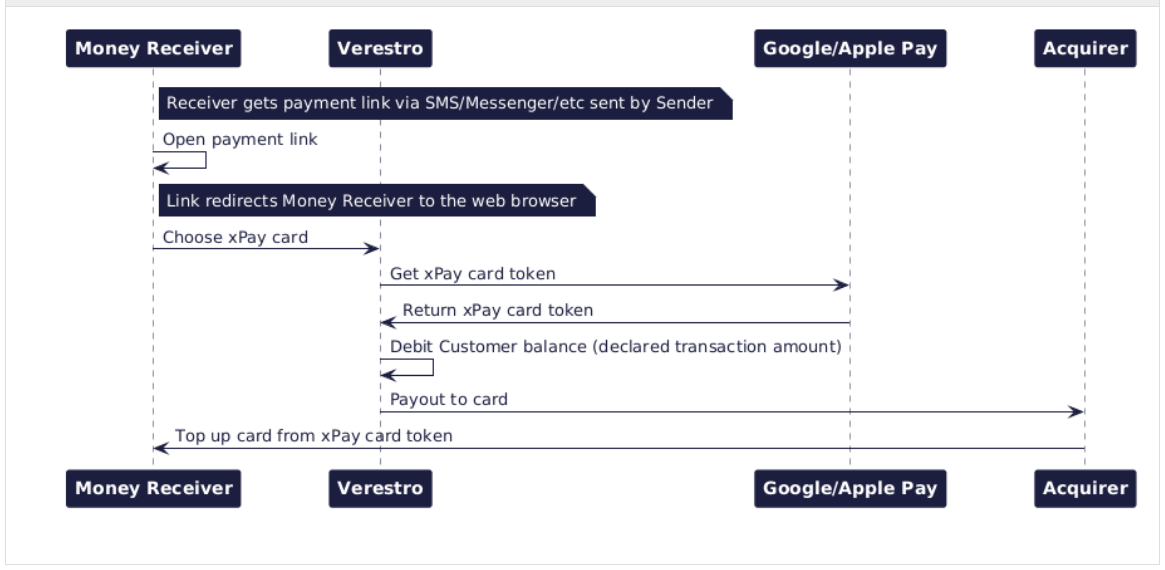

How does Payout to xPay work?

As mentioned earlier, xPay card tokens are generated and encrypted references linked to a real card stored in a user’s Apple Pay or Google Pay wallet. We also know that these tokens are used for making payments. But if they can be used for payments, can’t they also be used to receive money? The answer is yes - they can be, and this is exactly how the Payout to xPay solution by Verestro works.

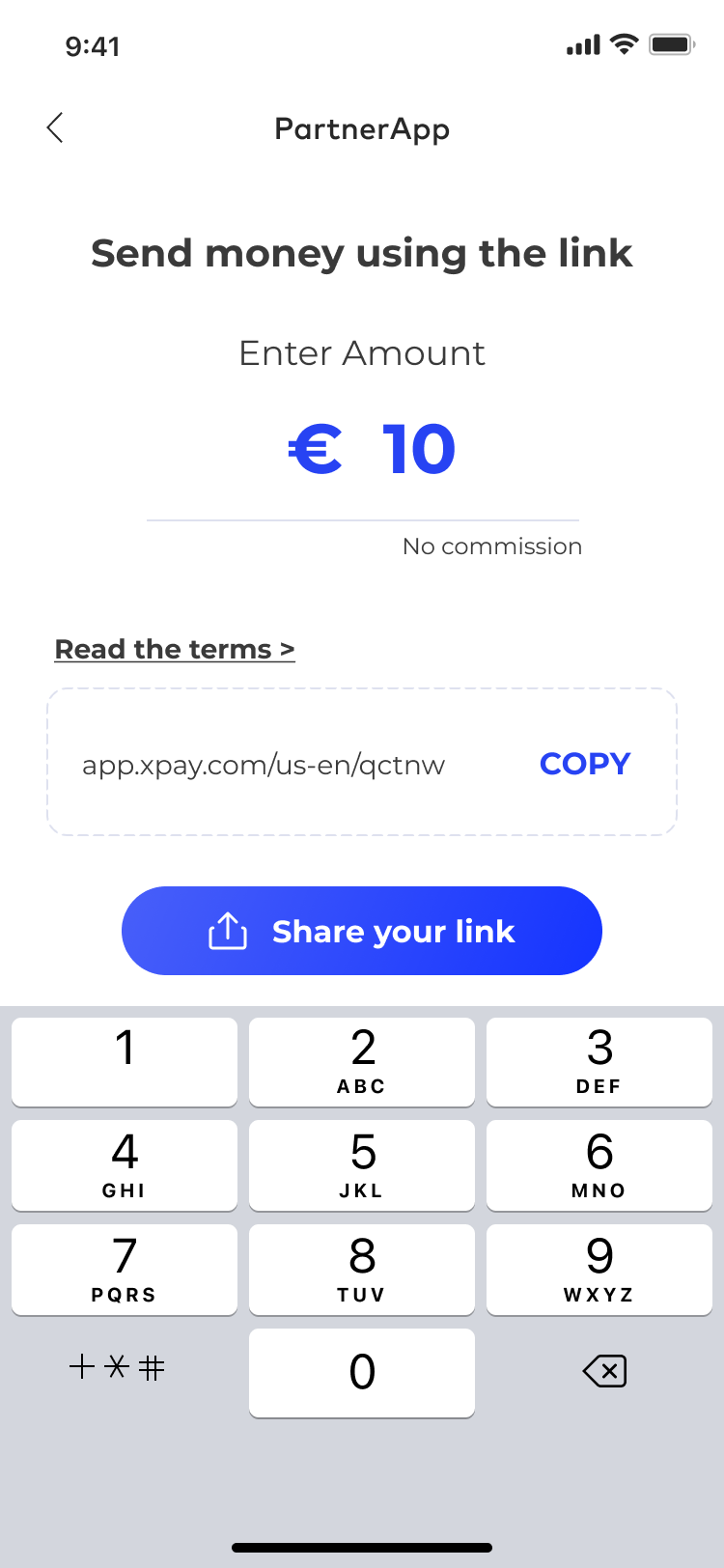

For example, let’s consider the following scenario: the sender does not know the recipient’s account number or card number. However, he has the recipient saved in his contact list in the Messenger app (or any other messaging app). The sender opens the Payout to xPay application, enters the amount and currency in which he or she wants to order the transfer. The app then generates a payment link, which the sender can share with the recipient via Messenger app (or any other messaging app). At this point, the sender’s role in the process is complete.

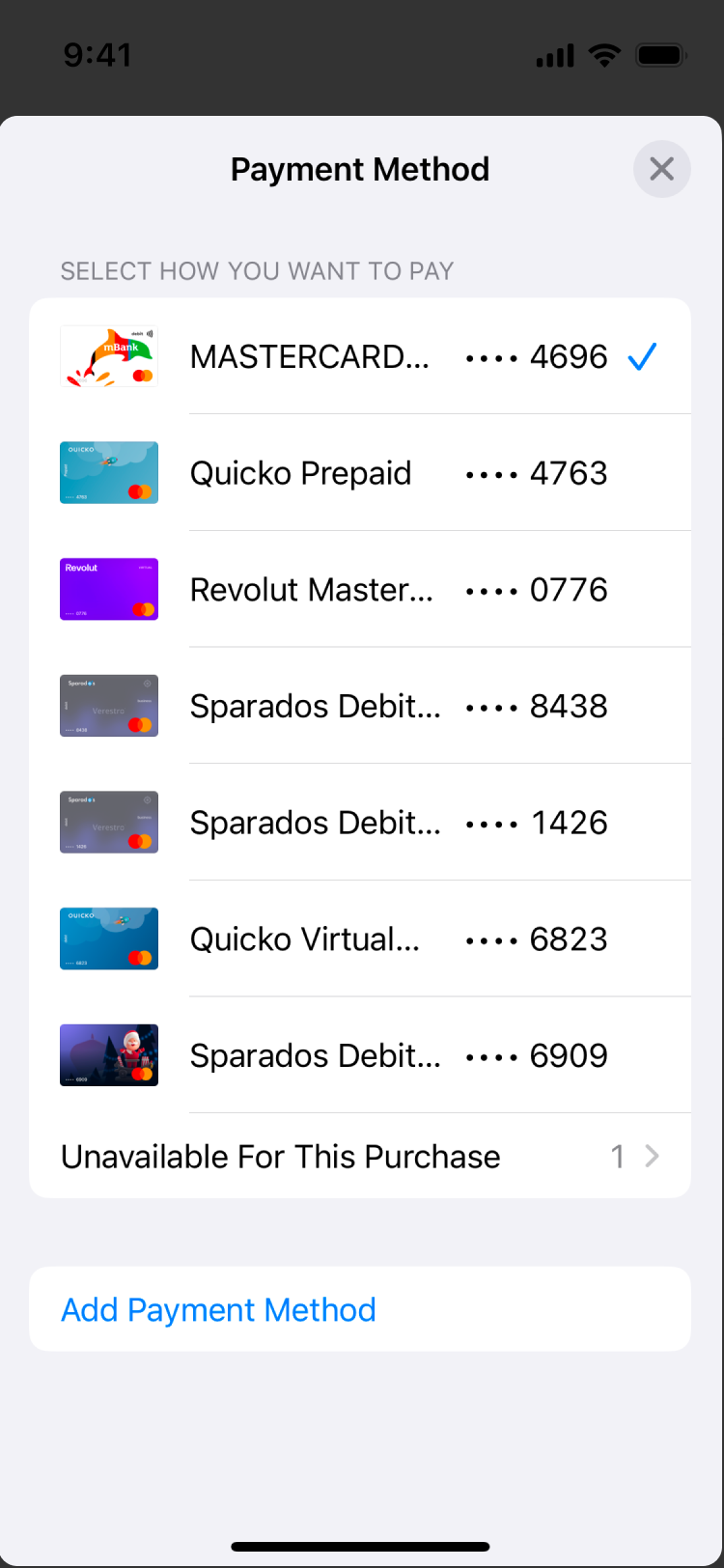

|

Sender's view |

|

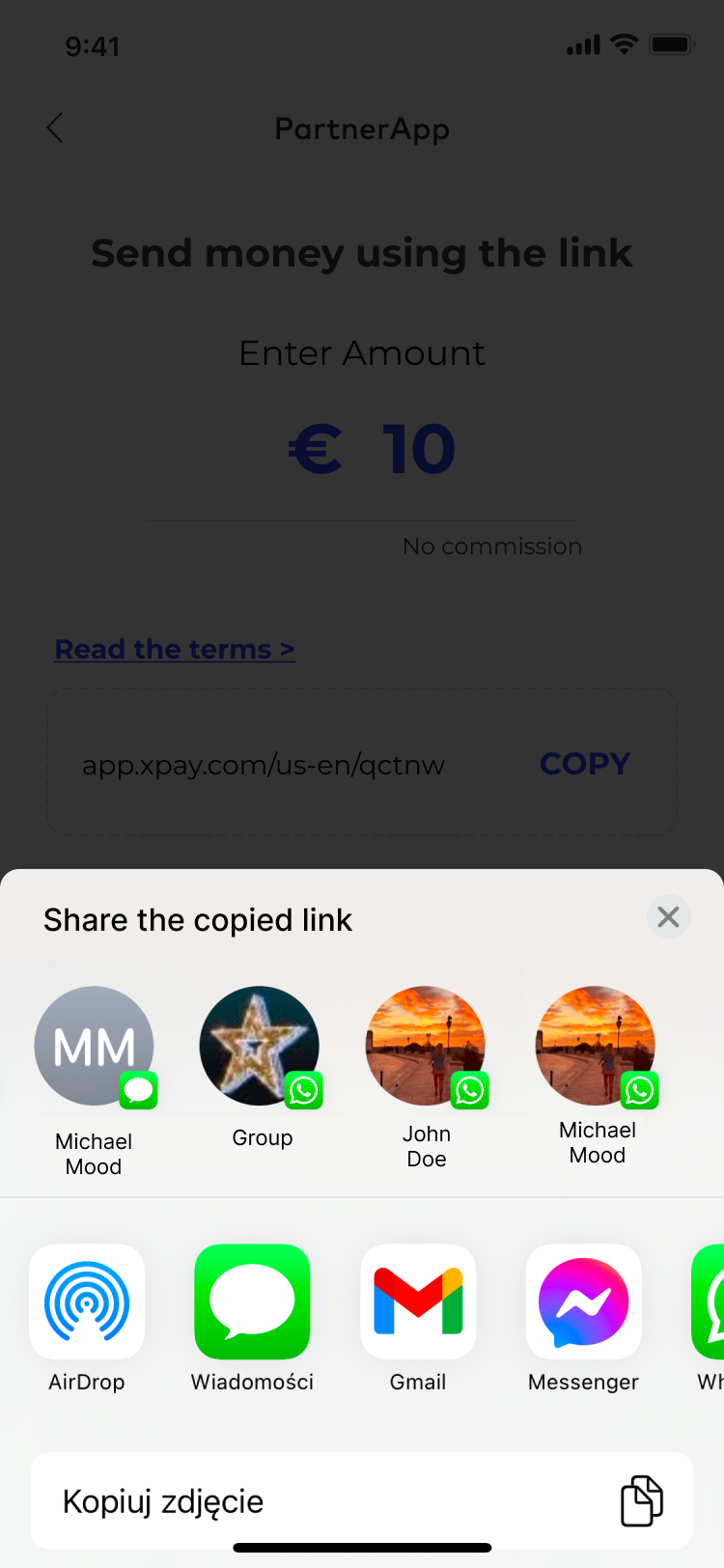

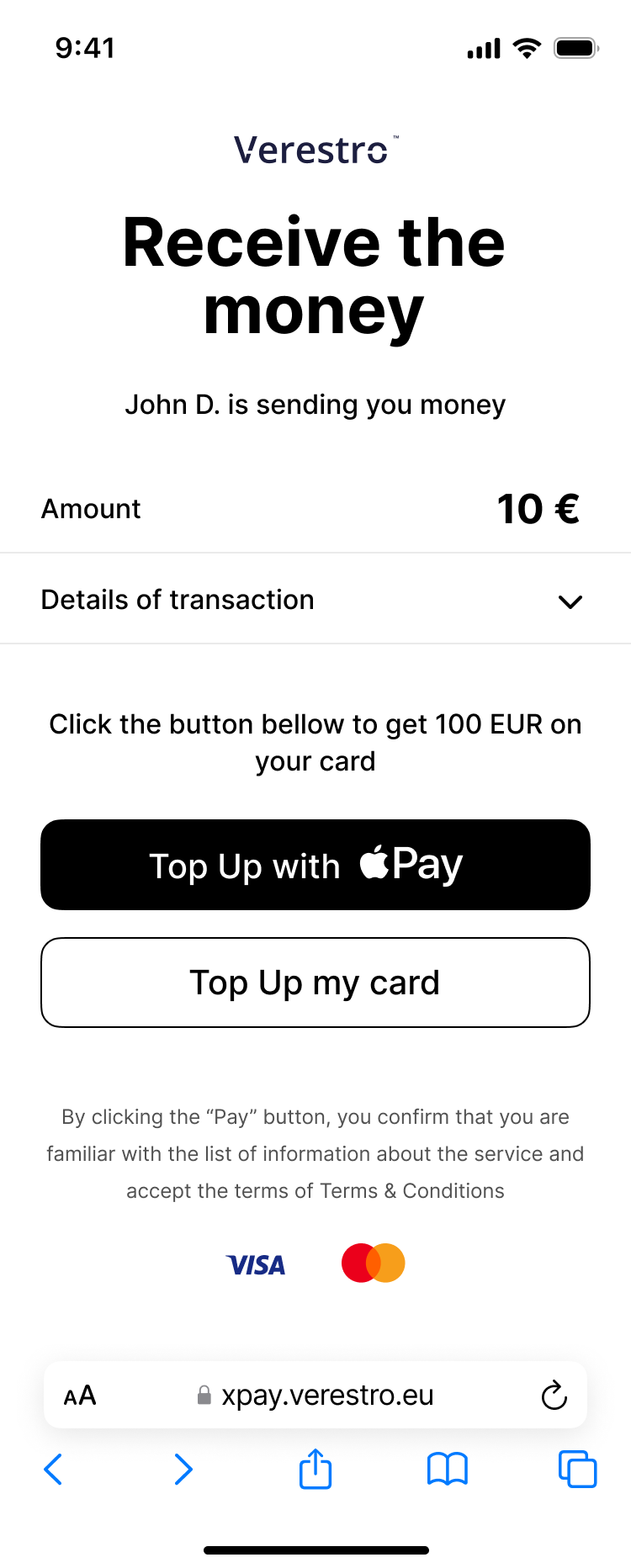

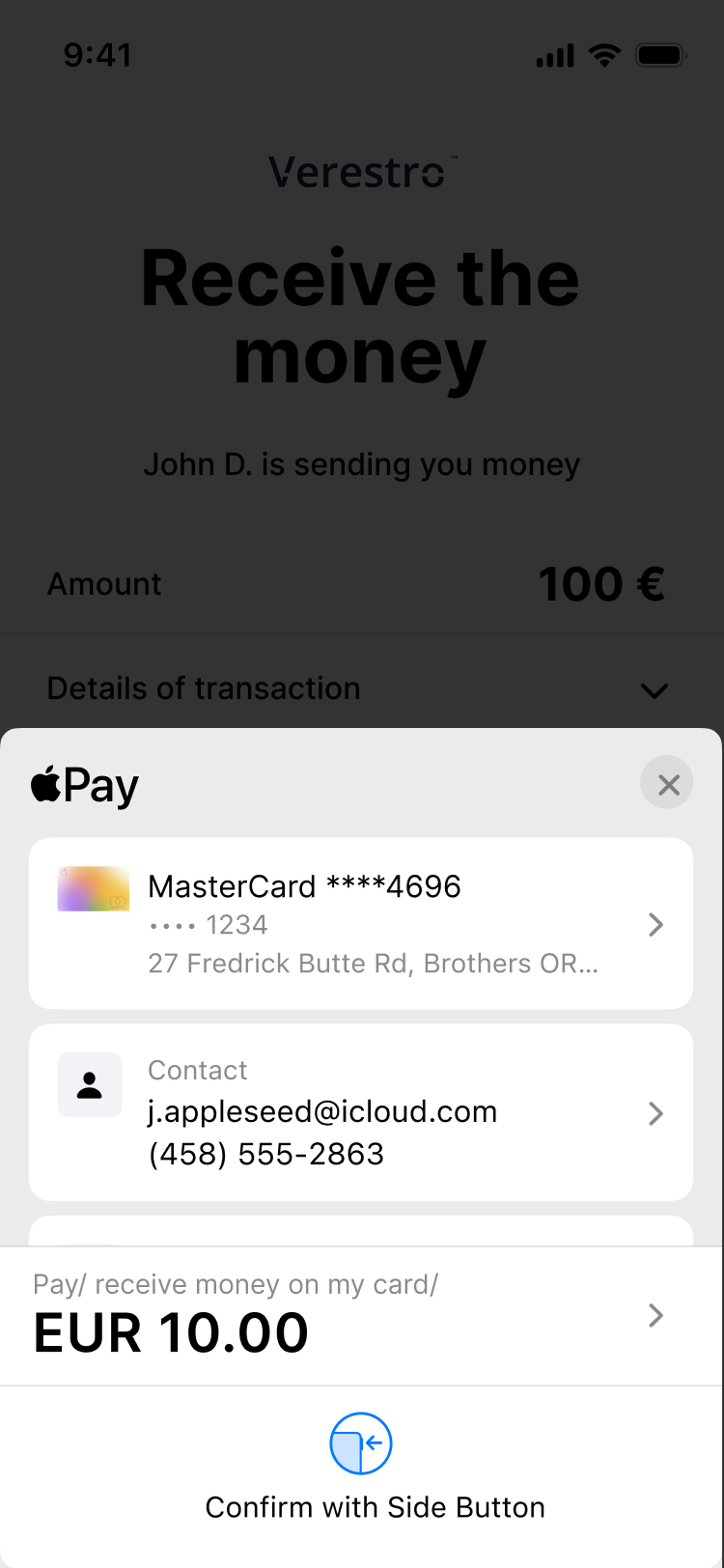

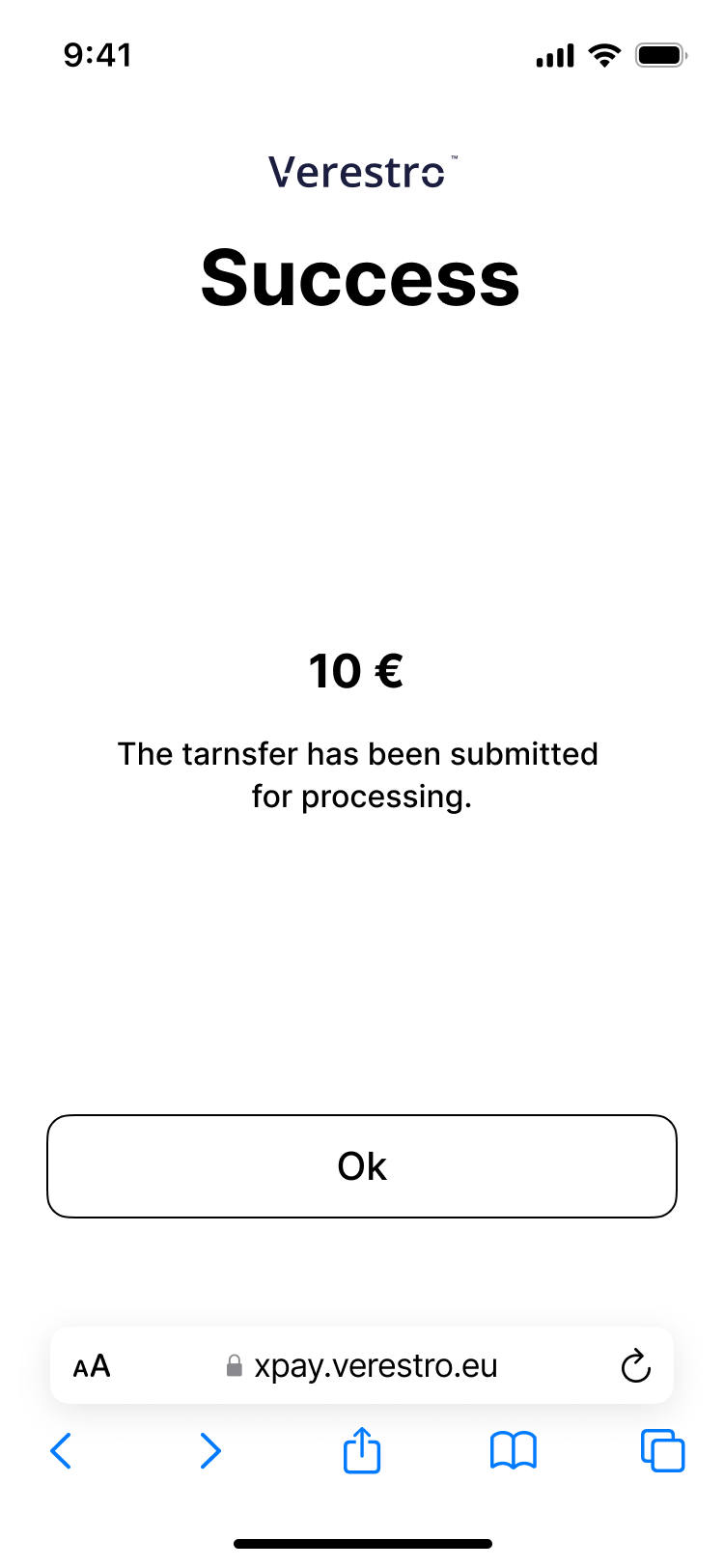

The recipient receives a message from the sender about the initiated transfer along with the payment link previously generated by the sender. By opening this link, the recipient is redirected to a view with the details of the transfer that was initiated for him. In this view, there is also an Apple Pay button (iPhone or other iOS device) or Google Pay button (Android, Windows or other non-iOS device). After opening the xPay wallet, the recipient selects the card to which he or she wishes to receive the funds. The xPay server returns a card token generated for the selected card to our application (The token is encrypted with Verestro's public key, so no one else has access to it), and our application initiates the transfer of the amount and currency sent by the sender to the chosen recipient's card.

| Recipient's view | ||||

|

|

|

|

|

Card to Card Widget - How Does it Work?

Verestro created the product Card to Card Widget to simplify and speed up cross-border money transfers by eliminating the barriers of traditional methods.

Transfers made using the Card to Card Widget can be carried out by users registered in our service to recipients using our client's services, e.g. a bank, which ensures fast and secure transfers without the need to use traditional, often more expensive, international transfer methods.

What is the Card to Card Widget solution from Verestro?

The Card-to-Card Widget is an intuitive solution for making money transfers directly between payment cards. To start using the service, the user goes through a quick and convenient registration process, which can be completed using popular platforms:

-

Google,

-

Apple,

-

Facebook.

After logging in, the user goes through an intuitive KYC (Know Your Customer) process which allows for instant identity verification in accordance with the AML (Anti-Money Laundering) regulations. The system automatically analyzes user data, ensuring the highest level of security and protection against financial fraud.

After a successful verification, the user gains full access to the functionality of the service and can make cross-border transfers using Visa and Mastercard cards.

The user can perform the transfer based on one of the following paths:

-

manual process: the user independently enters his/her card and recipient's data, specifying the transaction amount.

-

money request: the user receives a special link with previously defined recipient data and amount. The users can modify the transfer amount and select the card from which they want to send funds, without having to manually enter the information.

Regardless of the chosen path, the Card-to-Card Widget allows you to save both your card and give it any name, as well as to the recipient, so that the user can quickly and conveniently make subsequent transfers using their individual database of saved contacts.

Once the transaction is completed, the user receives email confirmation containing details of the transfer and its status. Plus, the full history of transfers made is available directly in the Card-to-Card Widget, which enables monitoring operations, expense control and quick access to archived transactions.

To ensure the highest level of security, the Card-to-Card Widget uses advanced data protection mechanisms, including information encryption, transaction authentication and full compliance with the PCI DSS standard. Thanks to this, every operation is protected against unauthorized access, and users can be sure that their data and funds are protected in accordance with the highest industry standards.

Who can benefit from launching the Card to Card Widget?

The Card-to-Card Widget is a comprehensive solution that enables fast, safe and economical money transfers. Thanks to it, our clients' users, especially from non-European countries, can receive funds from their friends, family or employers in Europe without having to choose between processing time and costs. The product can be used by a variety of industries, including:

-

Banks – Traditional and digital banks can integrate the Card-to-Card Widget, offering their customers convenient and fast international transfers,

-

Fintechs – Payment operators and fintech startups can expand their offerings with instant card transfers, increasing user satisfaction and loyalty.

However, the service has a much broader application and evolves in line with customer needs, also filling gaps in other areas where there is a need to optimize international peer-to-peer transfers.

What problems does the Card to Card Widget solve?

The Card to Card Widget is the answer to a number of problems that result from the limitations of traditional money transfer methods. This service effectively solves the challenges related to cost, processing time, convenience and availability of international transfers, while offering many benefits for both users and companies. Here are the main areas where the Card to Card Widget meets your needs:

-

Cost and speed - traditional transfers, especially international ones, are often associated with long waiting times and high costs - especially in the case of transfers between different continents. A direct transfer between cards reduces costs and shortens transaction times. Thanks to this, people from e.g. African countries can receive funds from senders in Europe without unnecessary barriers and on more favorable terms.

-

Convenience - thanks to the webview technology, users do not have to install additional applications, in addition, a simple and intuitive interface without the need to provide complicated banking details.

-

Accessibility - in many regions where access to traditional banking services is limited, Verestro helps to increase financial inclusion.

-

Reach - global and wide application enables both the use and increased competitiveness of many businesses.

What are the customization possibilities?

The Card to Card Widget offers a range of customization options that allow for full integration with your unique business needs and preferences. Here are the key personalization options:

-

Registration and login: Users can choose one of the popular login methods – Facebook, Google or Apple. It is also possible to add other social media login methods, which makes the registration process quick and convenient.

-

Currencies: The ability to configure different currencies - PLN, EUR, USD, allows for flexible adjustment of the service to international transfers and local user needs.

-

Branding elements: Personalizing the interface allows you to customize the background, logo or header to match your brand identity, allowing for full visual consistency with the rest of the platform.

-

Transaction load: The service gives flexibility in terms of who bears the transaction costs - the sender or the recipient. This functionality is ideal for customization according to company policy and user needs.

With these options, the Card to Card Widget can be fully tailored to each client's specific requirements, offering both convenience for users and flexibility for businesses.

Why should you choose Verestro’s solution?

The Verestro solution stands out from competing offers thanks to its holistic approach, which includes the development of functionality for both the end user and the business customer. Our easy integration makes the service fit seamlessly into existing systems, significantly increasing their attractiveness and value.

In the near future, we can expect the development of a dedicated panel enabling monitoring and analysis of transfers, functionalities in webview itself that will further simplify the process, as well as additional solutions to increase the level of security.

If you want to learn more about how Verestro can enhance your business with international card to card transfers, contact us today!

Cross-Border Card Transactions – Questions about FX Rates and Cash Flow

The topic of settlements of cross-border card transactions is often touched by our customers. It is not always clear how various fees are calculated. In this article we would like to explain how it works in detail.

The standard transaction flow

In general, a cross-border transaction works in the same way as a domestic transaction:

1. The cardholder presents the card to the merchant or terminal (either online by entering card data, or in a contactless way or as a standard plastic card transaction or at an ATM).

2. The acquirer gets card and transaction data from the terminal.

3. Based on the BIN table, the acquirer sends transaction authorization to Mastercard or VISA (Payment Schemes).

4. The payment scheme transfers authorization to the card issuer.

5. The card issuer approves or declines the authorization and blocks the amount on the cardholder account.

6. In case of approved transactions, the acquirer prepares a clearing file and sends it for settlement.

7. The payment scheme receives a clearing file and processes it.

8. The payment scheme takes money from the issuer settlement account and transfers it to the acquirer settlement account.

9. The payment scheme settles fees between itself, the issuer and the acquirer.

10. The merchant receives money for the transaction.

11. The acquirer charges merchant fees.

The added complexity of currency conversion in cross-border transactions

As mentioned above, this process is the same for domestic and cross-border transactions. However, in cross-border transactions the currency conversion process takes place, bringing an additional layer of complexity. As conversion applies at various moments of transaction, let me describe this in detail below:

1. Merchant and Acquirer

a. The merchant can agree with the acquirer that they want to receive money in one or multiple currencies. Depending on this contract, the acquirer will transfer money to the merchant in those currencies. It is impossible that ALL currencies in the world will be used, so usually merchants want to receive money in a few main currencies

b. The acquirer has Settlement Services with payment schemes in several or many currencies.

c. Depending on the Settlement Services, if a transaction is performed in currency X, the acquirer receives money in currency X. No currency conversion cost will apply at a payment scheme.

d. However, if the transaction is performed in currency X, but the acquirer does not have Settlement Service in this currency, the payment scheme will convert currency X to currency Y and send money to the acquirer in currency Y.

e. The acquirer will receive currency Y on their bank account and will either convert it to the merchant settlement currency or will transfer it directly to the merchant in currency Y.

f. Various fees charged by the acquirer can apply if the acquirer is performing currency conversion.

2. Payment Scheme

a. As described above, acquirers have Settlement Services enabled by Payment Schemes. Issuers have the same.

b. The issuer can have Settlement Service in main currencies:

i. Local currency

ii. EUR settlement

iii. USD settlement

iv. Eventually in other currencies

c. Every new Settlement Service is a paid service, so both issuers and acquirers must decide which is the correct setup of settlement services. Depending on this decision, the Payment Scheme will perform more or less currency conversion operations and will earn fees during this process.

d. The Payment Scheme provides issuers and acquirers with currency conversion tables which can act as a directional FX rate for them. However, the real FX rate for a particular transaction is performed at the moment of transaction settlement at the Payment Scheme.

e. This means that if the cardholder performs a transaction, his/her issuer is never sure what will be the settlement amount for this transaction

3. Issuer and Cardholder

a. Finally, depending on the Settlement Service agreed with the Payment Scheme, the issuer enables cards for their users.

b. The cardholder has usually (actually always) a payment account connected with this card and the cardholder knows that he/she holds money in a particular currency enabled by his/her bank / issuer.

c. It means that all transactions on this payment account will be charged in this particular currency.

d. Depending on the currency of the transaction and the settlement service enabled by the payment scheme, the issuer will perform the currency conversion and charge the cardholder additional fees.

Conclusion

This topic is highly complex and depends on many factors. Issuers and acquirers must make a decision which approach is the best for them, which Settlement Services to enable with Mastercard or VISA and what should be the fee charged for this service because it is impossible to avoid all risks connected with currency conversion changes.