Verestro product overview

Overview of Verestro’s platform and global product offering tailored to regional needs and project requirements.

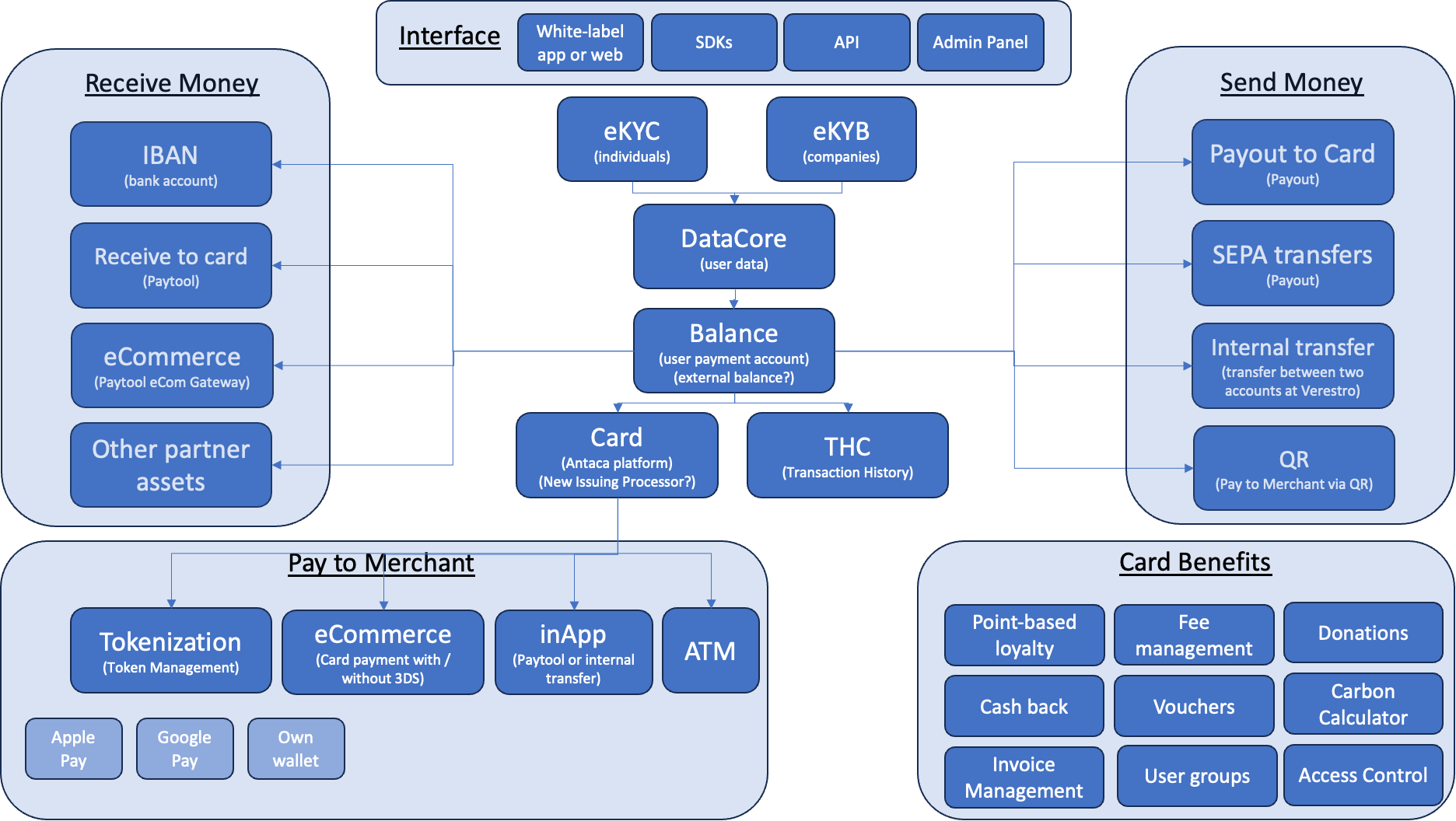

Verestro architecture and choice of products

Below simplified example of Verestro platform architecture. Before every project please decide which functionalities are you going to use.

Please tick bullet points which are needed in your project and deliver it to our sales team:

- INTERFACE

- White-label app

- White-label web

- SDKs - android and iOS, to minimise PCI issues

- APIs

- CORE

- eKYC - are you going to register consumers? do you have own KYC solution or want to use ours?

- eKYB - are you going to register business customers? do you have own KYB solution or want to use ours?

- Data Core (any user data will be delivered to Verestro) - almost always needed

- Balance

- Card - do you want to use our issuing processing capabilities or you have another issuing processor

- Transaction History

- RECEIVE MONEY

- IBAN for receiving

- Receive to card

- eCommerce gateway - do you want to use our acquirer or you have another acquirer? which ways of payments?

- Other partner assets - do you want to reload cards with points, digital assets etc.

- SEND MONEY

- Payout to Card - sending money to any VISA or Mastercard card?

- SEPA transfers

- Internal transfers between our accounts

- QR payments

- Other ways of sending money?

- PAY TO MERCHANT

- Apple Pay

- Google Pay

- Own wallet

- eCommerce payments

- inApp payments

- Payments from own wallet

- ATM

- CARD BENEFITS

- Point-based loyalty

- Fee management

- Donations

- Cash back

- Vouchers

- Carbon Calculator

- Invoice management

- User groups

We are constantly adding new value added functionalities. Check if we have not added something new in the meantime :) Contact us.

Verestro's products for various regions

Our mission at Verestro is to provide cutting-edge fintech technologies and make them affordable to everyone. We work with banks, fintech providers, payment schemes, payment gateways, merchants, corporations and small businesses and develop a BAAS / FAAS platform. However, as "payments" is a regulated business, we are not able to provide all our services globally at the moment. Below we describe key products we distribute in particular regions.

- The European Union

- Key customers: banks, fintech, payment providers, merchants, businesses, insurances, lendtech etc.

- Key products: all products described in our Developer Zone, including technology and regulated payments solutions.

- Taking into account market dynamics, our key focus is on:

- North & South America

- Key customers: banks, processors, payment schemes, fintech.

- Key products: we are focused on selling technology platforms because we do not have a payment license at the moment; we do work with various partners like Paymentology or Girasol to provide end-to-end payment solutions; we can offer payment accounts and cards in Europe if customer has office in Europe.

- Taking into account market dynamics, our key focus is on:

- East Asia incl. India

- Key customers: banks, processors, payment schemes, fintech.

- Key products: focus on technology products around tokenization and money transfers; we can offer payment accounts and cards in Europe if customer has an office in Europe.

- Taking into account market dynamics, our key focus is on:

- Middle East & Africa

- Key customers: banks, processors, payment schemes, fintech.

- Key products: focus on technology around tokenization and white label; we can offer payment accounts and cards in Europe if customer has office in Europe: